Zoë Butson is VP, Capital at RBCx where she specializes in fund finance and credit. Zoë advises venture capital and growth equity firms on overall fund formation and management, and supports the broader Capital team’s fund of funds investment strategy.

As private markets continue to grow in both absolute and relative terms, the pressure for fund managers to generate superior returns for their investors is ever-increasing. Although making sound investments is the primary vehicle to generating returns, another less obvious, though integral component, is responsible fund management, of which capital call facilities (“CCFs”) are a key feature. CCFs – also known as subscription lines of credit – have become increasingly prevalent within the private funds ecosystem, and for good reason. This piece will provide an introductory overview of how CCFs function, the benefits of their use, common structuring terms, and why we maintain that they’re an important extension to traditionally structured private funds.

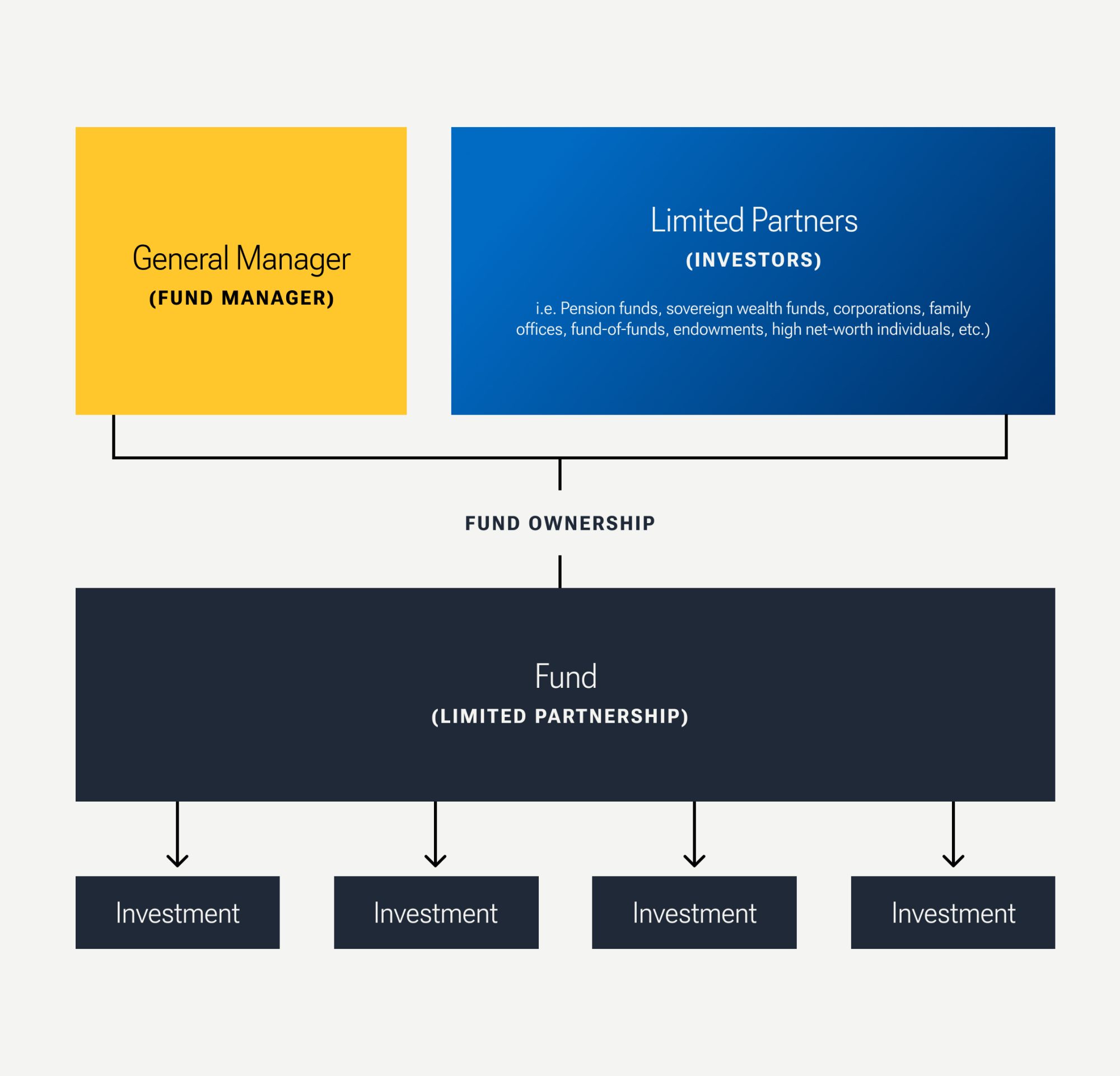

Before delving into the kinetics of CCFs, let’s begin with a high-level overview of the operations of a traditional closed-end private market fund. The figure below illustrates a simplified structure of a standard venture capital (“VC”) fund.

Institutional private market funds manage capital for various third-parties, including institutional investors like pension funds, endowments, and large corporations, as well as non-institutional investors, such as family offices, and high-net-worth individuals (“HNWIs”). When a VC or private equity (“PE”) fund is raised, the fund managers – referred to as General Partners (“GPs”) – solicit potential investors for capital contributions to the fund. Investors in private market funds are referred to as Limited Partners (“LPs”).

The fund’s GP is responsible for managing the fund on behalf of LPs throughout the fund’s entire lifespan (typically 10 years). The GP must raise capital commitments from investors, make investment decisions, and call capital from LPs to fund their investments in portfolio companies (more on this below). GPs are also commonly required to commit personal capital to the fund to signal to their LPs that they’re willing to invest their own capital, thus aligning their interests with LPs, and ensuring that they’re incentivized to make sound investment decisions.

Fund managers often create a separate “management company” entity, which is responsible for administering the fund, employing the GPs, and managing the firm’s operations and expenses (i.e. salaries, legal fees, travel costs, etc.).

To illustrate everything we’ve discussed so far, let’s use an example of a fund manager who has successfully raised $100 million in commitments from LPs. The GP now has a $100 million fund at their disposal from which to make investments, but they don’t actually have this $100 million sitting in their bank account. When LPs “commit” to a fund, they’re doing just that – making a commitment to pay into the fund when called upon at a later date. A capital commitment is essentially a legal promise to the fund manager that they’ll provide the requested funds upon request by the GP. This capital request is commonly known as “calling capital.” In normal circumstances, if a fund manager wants to invest in a company, they’ll send a capital call notice to their LPs 10-15 business days in advance of the investment date.

The key takeaway here is that in the absence of a credit facility, each time a fund manager wants to make an investment, they have to knock on their LPs’ doors to request funds 10+ business days ahead of the intended investment date. Funds might have anywhere from 10-200+ LPs, and one can imagine the administrative burden associated with calling capital and ensuring you have received wire payments from every LP by the intended investment date. Not only does this onerous process hinder the fund’s ability to execute quickly on time-sensitive or competitive deals, but if even one LP is delayed in making their commitment, it can impede the execution of the investment.

This is where capital call facilities come in. These credit facilities are now nearly ubiquitous amongst fund managers, as the benefits extend to GPs as well as LPs.

Capital Call Facility Benefits to GPs and LPs

Capital call facilities were designed to support fund managers to bridge the time between when the fund makes an investment in a company and when capital contributions are called from LPs to finance said investment. The use of these facilities effectively enables a fund to reduce the frequency of capital calls to once or twice a year, thus reducing a significant operational burden for both GPs and LPs.

With a CCF in place, GPs can draw on their facility to make multiple investments and then call capital at a pre-determined cadence to repay the line, alleviating the inefficiencies associated with making individual capital calls for each investment. Instead of having to plan investments out weeks in advance in order to collect funds on time, GPs can access liquidity quickly, allowing them to finance both the cost of investments, as well as general fund expenses. That said, the benefits of a CCF are not exclusively administrative.

From a performance perspective, the Internal Rate of Return (“IRR”) is the primary benchmarking metric used to evaluate fund performance. The IRR is a representation of the fund’s annualized returns from inception to a particular point in time. The importance of the IRR lies in its incorporation of the time value of money (e.g. a dollar today is worth more than a dollar tomorrow, and without a doubt more than a dollar 10 years from now).

The critical insight here is that the IRR clock starts ticking when capital is called from LPs, not when an investment is actually made. If a GP can execute on an investment by borrowing money rather than by calling capital from its LPs, the LPs are able to retain their capital for longer, and as a result, generate additional returns without any adverse consequences to the fund’s account.

For a simple illustration, let’s assume that a fund makes an investment into a company, and three years later the value of the company triples. In the first scenario, the fund GP calls capital from its LPs immediately, and in the second scenario the GP borrows at 5% interest and delays its capital call by a year. In the first scenario the investment would record an IRR of 44%, whereas in the second scenario, it would record an IRR of 66% after accounting for the 5% interest payments – a significant delta. This is not an optical illusion. In the second scenario, the GP has functionally doubled its investment in two years instead of three. When extrapolated to the entire fund, the impact to GPs and LPs becomes significant. In this way, fund management magnifies sound investment decisions to optimize total economic value.

As outlined in the previous scenario, LPs are sophisticated investors who typically invest across multiple asset classes. Often, LPs make capital commitments to multiple private funds and face the challenge of balancing liquidity with the often unpredictable timelines of capital calls. Funds make investments at irregular intervals, meaning it wouldn’t be unreasonable for there to be mere weeks between investments and the fund calling capital from LPs multiple times. It’s burdensome for LPs to ensure they’re executing on each capital call in a timely manner, especially if they have multiple positions in private funds where capital is called on a sporadic basis. Moreover, there’s a meaningful opportunity cost to holding capital liquid that could otherwise be generating a return elsewhere, and inherently, funds that lack the ability to schedule capital calls in advance through the use of a CCF are substantially less attractive to LPs than those who employ such facilities.

How Do Capital Call Facilities Work?

CCFs are underwritten to the capital commitments from LPs. They’re typically structured so that the facility can be drawn upon, repaid several months later, and re-drawn as necessary throughout the lifetime of the fund. It’s important to note that lenders typically have no recourse to the underlying investments in a fund, so the assets of the portfolio companies aren’t implicated in any way by virtue of the loan. Although the lenders don’t have recourse to underlying assets, they can restrict distributions back to LPs in an event of a default on the credit facility.

Security on such facilities customarily involves a pledge against the fund’s uncalled capital commitments. This provides the lender with the right to force capital calls and enforce payments of commitments, along with allowing the lender to receive the proceeds of such capital calls for repayments of the facility.

Facility terms are primarily contingent upon the LPs of the fund and the conditions outlined within the borrowing section of a fund’s Limited Partnership Agreement (“LPA”). The LPA should explicitly permit the fund to incur indebtedness, and grant security over the LPs’ uncalled capital commitments and right to make capital calls.

LPAs typically permit borrowing at a level of 15% to 20% of total capital commitments and commonly stipulate that borrowings be repaid within 180 or 365 days.

How Do Lenders Look at These Facilities?

Despite what is permitted within a fund’s LPA, the degree of flexibility that lenders are able to offer comes down to the LP composition of the fund, and ultimately, the level of institutional capital within the LP base. As capital call facilities are secured against capital commitments from investors, lenders need to have confidence that the underlying LPs won’t fail to provide capital in a timely manner when a capital call notice is issued by the GP.

If you put yourself in the shoes of a lender, it’s fairly intuitive to understand why you would have more comfort lending to a fund where the lion’s share of capital commitments are sourced from investment-grade institutional investors (i.e. Schedule I banks, pension funds, crown corporations, rated corporations, etc.) as opposed to a fund with the bulk of commitments sourced from high net-worth individuals (“HNWIs”) and family offices. Since capital commitments are essentially just a promise to pay, the lender needs to have comfort that when called upon, the LPs will advance.

Although HNWIs and family offices may have significant liquidity, strong management practices, creditworthiness, and the capacity to be stellar LPs, the challenge facing lenders comes down to information asymmetry. Lenders tend to have less comfort with these LPs due to insufficient knowledge, as compared to the significant publicly accessible information available for institutional LPs.

Typical Terms and Fund Processes

Funds typically set up a CCF in tandem with their first close so they’re able to draw upon their facility to finance investments and fund expenses without having to call capital from their initial LPs.

A key feature of the CCF is the “borrowing base”, which allows for the facility availability to scale as the fund completes subsequent closes. Let’s bring back our example of a $100 million fund. Say that this fund’s LPA allows for the fund to borrow up to a maximum of 20% of the aggregate committed capital, and that borrowings may remain outstanding for a maximum of 365 days. Let’s assume that 80% of capital commitments are sourced from investment-grade institutional investors, and the remaining 20% are commitments from HNWIs. Since this fund has a strong LP composition, lenders are likely to offer the fund a 365-day repayment term, and a facility size of $20 million (the full 20% of aggregate committed capital as permitted within the fund’s LPA).

While it sounds as if the fund has a $20 million facility to leverage, this may not always be the case due to the way capital call facilities are typically margined. Typical borrowing base terms that may be offered to the fund in our example would margin the CCF availability at the lesser of:

- The Facility Amount ($20M – Based on the fund’s estimation that they’ll close a $100M fund, and the lender’s willingness to provide a 20% facility);

- 20% of Aggregate Capital Commitments; and

- 50% of Aggregate Uncalled Capital from all LPs

Margining against a percentage of total capital commitments allows lenders to provide funds with CCFs upon the fund’s first close at an amount tethered to the total capital commitments at that point in time, while simultaneously allowing the availability under the facility to grow as the fund secures further commitments. For example, a fund might target a ‘first close’ of $50 million if their final close target is $100 million. A first close enables the fund to begin making investments.

Upon this $50 million first close, the margining formula above would be calculated as the lesser of:

- $20M (The ‘Facility Amount’)

- $10M (20% of $50M in Aggregate Capital Commitments)

- $25M (50% of $50M in Aggregate Uncalled Capital [No capital has been called])

As $10M (b) is the lesser amount within the borrowing base formula, the availability upon a $50M first close would allow the fund to draw up to $10M on their facility. When the fund closes their target $100M, parts a) and b) under the margining formula will be equivalent, and the fund will have availability to borrow up to the full $20M.

Margining against a percentage of uncalled capital refers to the total amount of the fund that has not yet been paid by LPs. For example, if a $100M fund issues four capital calls for $10M each, the level of uncalled capital remaining in the fund is $60M. This tranche of the margining formula will only become relevant during the later stage of the fund’s investment period, when they have deployed and called the majority of the fund’s capital (i.e. in the formula above, part c) will only ‘kick in’ when the fund has called more than 60M [50% x $39,999,999 of Uncalled Capital becomes less than the facility amount of $20M]). Margining against uncalled capital means that availability under the facility will reduce as the fund continues to have less capital to deploy in the later stages of the fund’s life.

Final Thoughts

Fourteen years beyond the 2008 financial crisis, private markets are nearly unrecognizable due in no small part to the proliferation of fund finance products such as capital call facilities. CCFs have become a fundamental facet of modern fund management, now universally utilized amongst private fund managers globally.

At the core of their value proposition, CCFs offer an evidently superior alternative to the traditional administrative process of calling capital by reducing the frequency of capital calls, enabling funds to execute upon investments quickly, while simultaneously improving the fund’s IRR. The demand for these facilities is justified, as the benefits extend not only to fund managers, but also to their LPs, serving as a meaningful fund management tool.

In a future piece, we’ll discuss how other forms of innovative financial solutions may further enable funds to continue to innovate and optimize returns to their LPs. Stay tuned for the next piece, and get in touch with the RBCx Capital team to learn more.